Categories

- Additional Insured

- ChildrensProducts

- Claims Made

- Cyber Insurance

- Dietary Supplements and Nutraceuticals

- Ecigarettes

- Firearms Insurance

- Food Products

- Foreign Products Liability

- Foreseeable Misuse

- Frivolous Lawsuits

- General Liability

- Industrial

- Infographics

- Intellectual Property

- Looking ahead

- Marijuana Liability

- Medical Products

- Mutual Indemnification

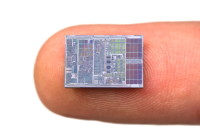

- Nano Technology

- News

- Online Sellers Insurance Requirements

- Outsourcing

- Piercing The Corporate Veil

- Pollution Liability

- Product liability

- Product Recall

- Retail Chain Store

- Start-Up Business

- Statute of Repose

- Surplus Lines Insurance

- Technology

Nanotechnology and Product Liabilty: The Great Unknown

Back in 2008, I wrote that nanotechnology business development would probably be forced to creep at a snail’s pace. I said that because insurance carriers view nanotechnology as the next “asbestos,” Surely that would be difficult to insure.

It turns out that maybe I was wrong. According to Lux Research, the nanotechnology industry is expected to increase 30 fold, from $100 billion in 2007 to $2.6 trillion in 2014. As many as 15% of all manufactured products are expected to rely on nanotechnology by 2014.

How will insurance carriers handle the increase in nanotechnology?

It’s interesting how many insurance carriers will line up to provide Product Liability policies for nanotechnology businesses. Ultimately, larger companies, such as DuPont and 3M, could either self-insure. Or they’ll bring enough premium to the table to attract some insurance carriers to provide Product Liability coverage.

However, claims are already being filed against some sunscreen companies that use nanoparticles in their products. I’m guessing most insurance carriers will wait before jumping in to provide Product Liability coverage for the new nanotech products.

Maximizing insurability with a proven track record

Insurance carriers need a proven track record of no claims before writing Product Liability insurance policies to small and medium-sized companies.

Their primary concern is that nanotech particles can be smaller than a virus and easily penetrate or be absorbed by human tissue. This could result in them handling severity-related claims, similar to asbestos claims.

Product Liability trial lawyers are already conducting seminars preparing their strategies on how to hit a home run similar to the asbestos grand slam.

-

Click the Button Below to Get Your

Click the Button Below to Get Your

No-Obligation Quotes from Among the

Top 18 Leading Insurance Carriers Today -

Recent Industry News

- Amazon Sellers and Vendors Strategy Including Insurance Requirements

- Walmart Sellers Insurance

- Product Liability Limit Requirements of Online Sellers

- State-by-State Product Liability Analysis of Laws Impacting Businesses

- Children’s Product Liability: Strange Claims and Need for Insurance

- Product Liability vs. Environmental Insurance for the Chemical Industry

- Product Liability in the 3D Printing Industry: New Materials and Their Significance

- Product Liability Concerns in Agricultural Equipment Enhanced with Artificial Intelligence

- Navigate Product Liability in Battery and Solar Industry

- Cyber Risk Insurance Is Essential Business Insurance in Today’s Modern World

Monthly News Archives